The current mortgage rates listed below assume a few basic things about you including you have very good credit a fico credit score of 740 and you re buying a single family home as your primary residence check out the mortgage rates charts below to find 30 year and 15 year mortgage rates for each of the different mortgage loans u s.

Current 30 year fixed mortgage rates mn.

Current mortgage and refinance rates print use annual percentage rate apr which includes fees.

Current rates in minnesota are 3 04 for a 30 year fixed 2 51 for a 15 year fixed and 2 97 for a 5 1 adjustable rate mortgage arm.

Mortgage rates are updated daily.

Current rates in minnesota are 3 081 for a 30 year fixed 2 717 for a 15 year fixed and 3 095 for a 5 1 adjustable rate mortgage arm.

Of the fixed rate mortgages 30 year terms generally have the highest interest rates and total interest costs and the longer term builds equity more slowly than would a 20 or 15 year term.

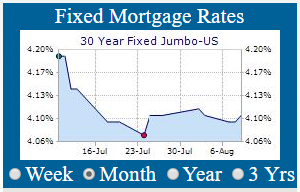

Current rates are hovering near three year lows amid.

For example many borrowers who select a 30 year fixed rate mortgage refinance well before even 10 years have passed.

Learn more about today s mortgage rates.

Minnesota 20 year fixed mortgage rates 2020.

The benchmark 30 year fixed rate hit a record low of 3 52 percent during the week of july 6 2016 according to historical bankrate data.

Check out our other mortgage and refinance tools lenders.

Use the search box below to change the mortgage product or the loan amount.

Click the lender name to view more information.

Compare minnesota 20 year fixed conforming mortgage rates with a loan amount of 250 000.

Fha loans annual percentage rate apr calculation assumes a 255 290 loan 250 900 base amount plus 4 390 upfront mortgage insurance premium with a 3 5 down payment monthly mortgage insurance premium of 176 30 and borrower paid finance charges of 0 862 of the base loan amount plus origination fees if applicable.

View daily mortgage and refinance interest rates for a variety of mortgage products and learn how we can help you reach your home financing goals.

How to read our rates.